We built RazorHelm in 2Q25 to fundamentally shift how we approach M&A strategy formulation with our clients. In fragmented software markets with thousands of potential targets, we needed a systematic way to assure comprehensive coverage and provide clients with deeper insight into their M&A SAM (Serviceable Addressable Market).

RazorHelm moves beyond one-off company analyses to provide a strategic foundation for understanding an entire sector of the market and how it’s evolving.

The Problem We Solved

We needed to move beyond lists of companies to understand what was real, what was rare, and what trade-offs matter when devising acquisition strategies with our clients. Before we built RazorHelm, we couldn’t see the forest through the trees.

Eliminates FOMO – RazorHelm illuminates the entire SAM, allowing us to weigh options and compare potential deals against what truly exists, rather than an idealized target. When we work with a client for six months to a year, we reach 60% of the SAM, which allows us to make better decisions with our clients.

Strategic Foundation – A single-view presentation of all opportunities allows clients to make informed trade-offs between “must-haves” and “nice-to-haves.” This grounds the SAM in reality, forming a pragmatic strategic foundation. An M&A strategy must reflect actual availability, not a wish-list, as if building a product.

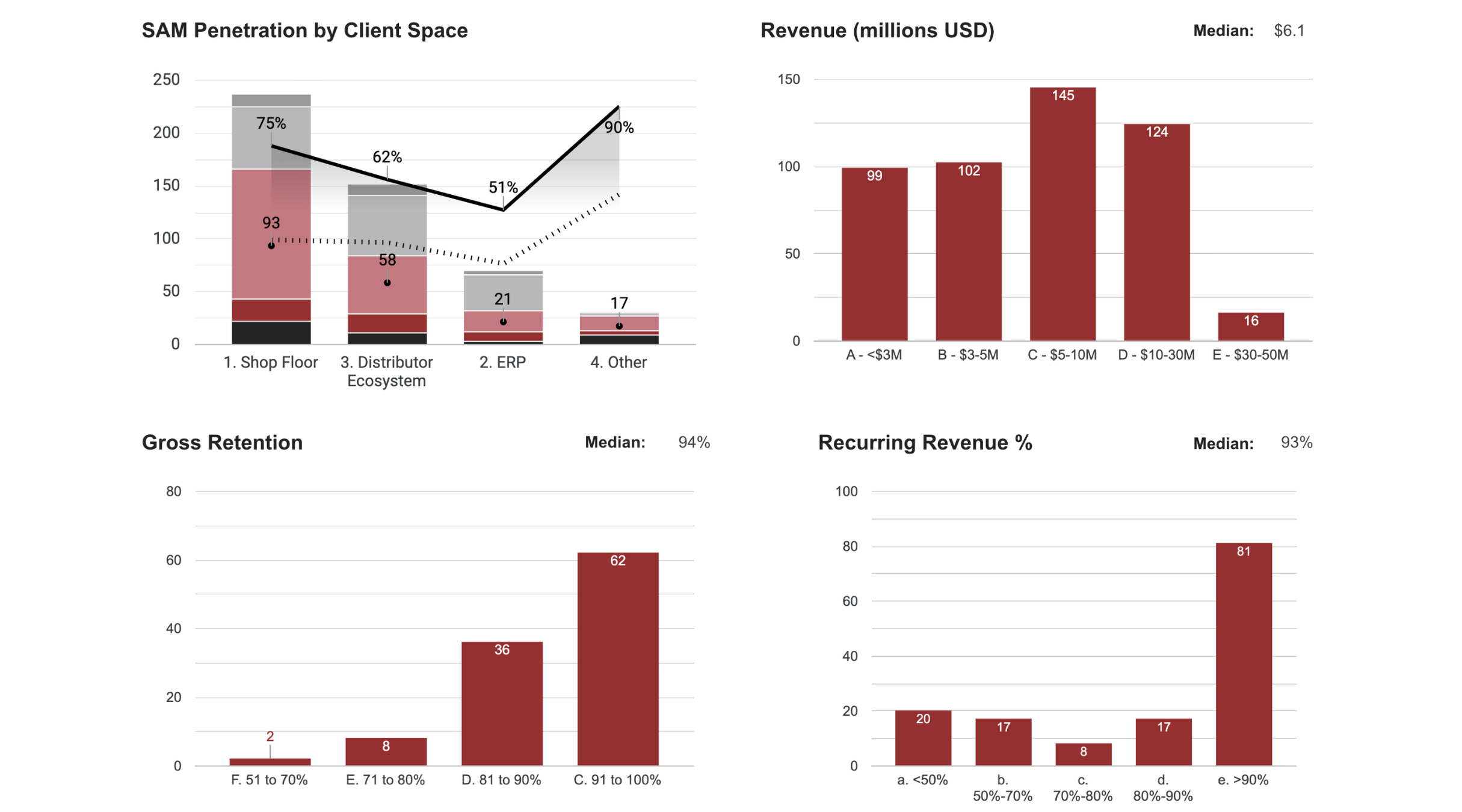

Pattern Recognition – By elevating our focus beyond single, isolated deals, we gain the crucial time and perspective needed to identify broader patterns that are shaping the software industry, which in turn informs and refines our M&A priorities. This approach also allows us to see the benchmark KPIs across various software segments, enabling us to compare potential targets against their truest, most relevant peer groups.

Calibration – We have found the KPI dashboard to be essential for illustrating how rare any combination of characteristics truly is. While the average company in a segment might have $10M revenue, 15% growth, 15% profit, and 93% gross retention, the dashboard reveals the likelihood of finding all those KPIs in a single company.

Competitive Intelligence – RazorHelm is essential for analyzing the supply of potential targets relative to the demand from competing acquirers. This competitive insight is crucial for developing our strategy, informing our bidding approach, and establishing a clear right to win. Monitoring venture investment activity provides early warnings about potential market disruptions. Together with insights from the companies in the segment themselves, we are able to build a comprehensive view of the market with our clients.

How We Use RazorHelm

RazorHelm is our essential framework for market engagement, driving client growth and ensuring our competitive edge by helping us deeply penetrate the client’s M&A SAM and effectively manage our coverage without missing opportunities. This process enhances our market understanding, allowing us to identify and prioritize outreach to critical targets, and spot potential adjacent markets to expand the SAM strategically without diluting our core narrative. As market conditions and client strategy evolve, RazorHelm provides the crucial historical context and up-to-date analysis needed to revisit and capitalize on ideas that become strategically viable.

Strategic, Not Reactive

Successful acquirers maintain flexible M&A strategies while remaining true to a clear set of strategic principles. Unlike product strategy, acquirers are limited by what exists in the market, and by who is willing to sell. By combining in-depth market insight with the necessary resources and skills, the most successful acquirers transform acquired companies to achieve superior returns.

RazorHelm has become an essential tool for our clients by empowering them to make data-driven decisions that lead to better outcomes.