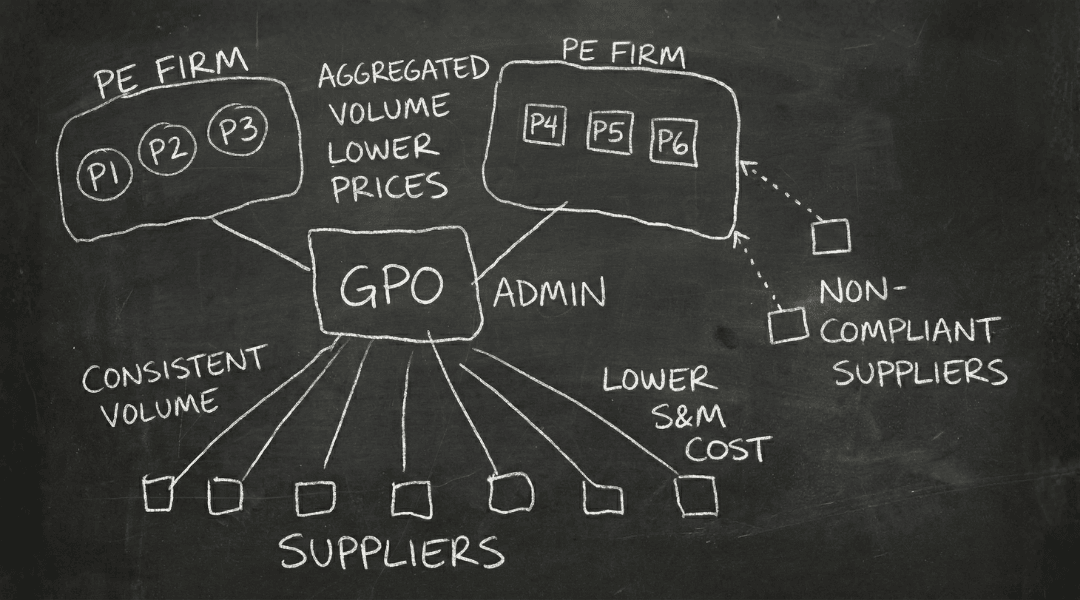

While Group Purchasing Organizations (GPOs) were initially founded to secure discounts through aggregating buying volume, they have evolved into software-enabled platforms that supplement procurement groups with crucial support. From the enterprise to SMB, procurement is an overburdened and understaffed function. GPOs supplement procurement teams with deep knowledge of supplier strengths and weaknesses, negotiations expertise, and oversight and compliance capabilities to ensure negotiated terms are fully realized. Some even help their buyers generate revenue.

At Razorhorse, we have identified over 500 GPOs and we’ve spoken with 50 across different sizes, segments, and geographies. The pattern is clear. GPOs are transitioning from analog rebate processing to sophisticated procurement infrastructure, and the shift is driving consolidation. Proper technology investment requires scale and expertise.

The GPO Value Proposition

GPOs create value on both sides of the market in three key areas.

Administrative Overhead

One GPO leader noted that half their value was fixing billing errors before their municipal members even saw them. By centralizing vendor relationships and auditing, GPOs effectively act as an outsourced procurement officer, saving members significant staff time, reducing administrative overhead, and eliminating the complexity of managing and reconciling dozens of disparate supplier contracts.

GPOs also bring expertise to teams stretched across spend areas, providing benchmarking and pricing transparency unavailable to individual buyers. They reduce risk by using vetted suppliers, accelerate procurement cycles through standardized agreements, and offer workflow and compliance support for internal teams.

As a result, procurement leaders are able to offload complexity, accelerate decisions, and avoid costly mistakes in categories where they lack necessary expertise.

Compliance

For both sides of the market, member compliance is the critical leverage point. GPOs that successfully drive high member usage of their contracts through software, analytics, and workflow automation are in a stronger position to create value. Compliance allows the GPO to guarantee volume to the supplier, which in turn unlocks better pricing, rebates, and terms for the members, strengthening the GPO’s position as a strategic channel.

Supplier-Side Value

For manufacturers, distributors, and service providers, GPOs reduce sales and marketing overhead and shorten selling cycles. Rather than deploying expensive sales teams to chase hundreds of buyers, suppliers pay GPO fees to access pre-qualified demand.

GPOs match suppliers with situations where they can actually succeed. Large suppliers gain increased access to buyers. Smaller suppliers get placed in situations where they’re more likely to win and retain business.

Contractual Defensibility

Exclusive, long-term supplier agreements are essential for a GPO’s long-term success. Securing them is challenging as it requires a significant, long-term commitment from both the GPO and the supplier, along with an initial demonstration of committed member volume.

The defensibility compounds over time. Members join to access exclusive contracts, and more members means increased negotiating leverage. Stronger leverage secures better terms and more exclusive agreements.

Breaking these contractual relationships requires either significantly better economics or fundamental changes in buyer or supplier strategy. Neither happens frequently.

Business Model Variations

Not all GPOs look the same. Some are member-owned, others are independent companies. Some specialize in specific verticals, others operate as broad horizontal platforms.

Even their economic models differ. The most common model is supplier funded, where the GPO’s revenue comes from commissions or volume-based fees paid by the supplier. This aligns the GPO’s incentive with its buyer members’ success, and the overall volume flowing through the negotiated contracts.

In some cases, buyers pay subscription fees or implementation fees, and sometimes both suppliers and buyers pay for participation in the GPO.

These differences influence incentives, pricing transparency, and how value is communicated.

The Evolution of Procurement

An important shift is underway in software. Modern GPOs are becoming procurement platforms with capabilities that were impossible under paper contracts and manual rebate tracking, including:

- Real-time analytics on pricing, purchasing, and compliance

- SKU normalization and catalog consolidation, critical in categories with inconsistent item masters

- Digital catalogs that plug directly into procurement systems

- Automated invoice matching and reconciliation

- Dashboards that reveal spend leakage and contract utilization

Software is not only improving the GPO model, it’s reshaping how GPOs create value.

Data accuracy, not contract volume, is becoming the real competitive advantage. A GPO with sophisticated procurement technology becomes harder to replace than one that simply processes rebates. The switching costs compound.

GPOs that normalize data, clean catalogs, and automate workflows increasingly look like specialized procurement technology companies. Those that continue to act as simple rebate aggregators struggle to remain relevant.

The GPO+ Model

Best-in-class GPOs are expanding into higher-margin, higher-leverage services:

- Consulting and category management

- Logistics coordination and distribution partnerships

- Payments, FX, and embedded financial tools

- White-labeled procurement portals for members and suppliers

- Marketplace models that centralize purchasing workflows

This “GPO+” model generates significantly higher margins than traditional administrative fees. It positions the GPO as an ongoing operational partner, not just a contracting intermediary.

Driving Revenue for Buyers

The concept of GPOs is rapidly evolving, with innovative organizations expanding beyond simple purchase discounts to offer a range of value-added services that drive revenue and operational efficiency for their members. We talked to a hospitality GPO that has started negotiating distribution deals for its member hotels with major booking platforms, giving independent hotels the distribution muscle of a large chain to drive incremental room revenue. They also negotiated payment processing deals enabling their member hotels to benefit from credit card payments for rooms and dining. We talked to another GPO that negotiated a marketing fund rebate from a soft drink provider that its restaurant buyers could use for advertising, which in turn increases the soft drink purchases in their restaurants benefiting the restaurant and the soft drink provider. We spoke with another that has begun helping its buyers liquidate excess inventory.

This evolution marks a pivotal shift in how GPOs deliver value, moving beyond mere cost savings to actively create new revenue streams for their members.

The Razorhorse Take

Group Purchasing Organizations are building increasingly defensible positions in B2B commerce through exclusive contracts, software-enabled platforms, and revenue-generating services.

Future winners in procurement will build platforms that become essential infrastructure, offer high-value services, secure long-term exclusive contracts, and help members generate revenue instead of just cost savings.

Incumbents own the relationships, data, and contracts. Startups own the technology and speed. Long term success in the category will require both.