It’s a tremendous time of growth at Razorhorse. In the last 18 months, we’ve brought on 14 new client mandates. We added 17 new members to our team in 2021 alone. Our team of 50+ is now advising more than 20 strategic and financial software buyers, with a focus on mergers and acquisitions (M&A) globally.

Working With Sell-Side Advisors

As we grow, we are also solidifying our unique market position as a complement to sell-side advisors and investment banks. We love when a sell-side advisor is involved in our acquisitions; we find very good goal alignment and streamlined working cadence with experienced advisors helping to guide a transaction from the sell side.

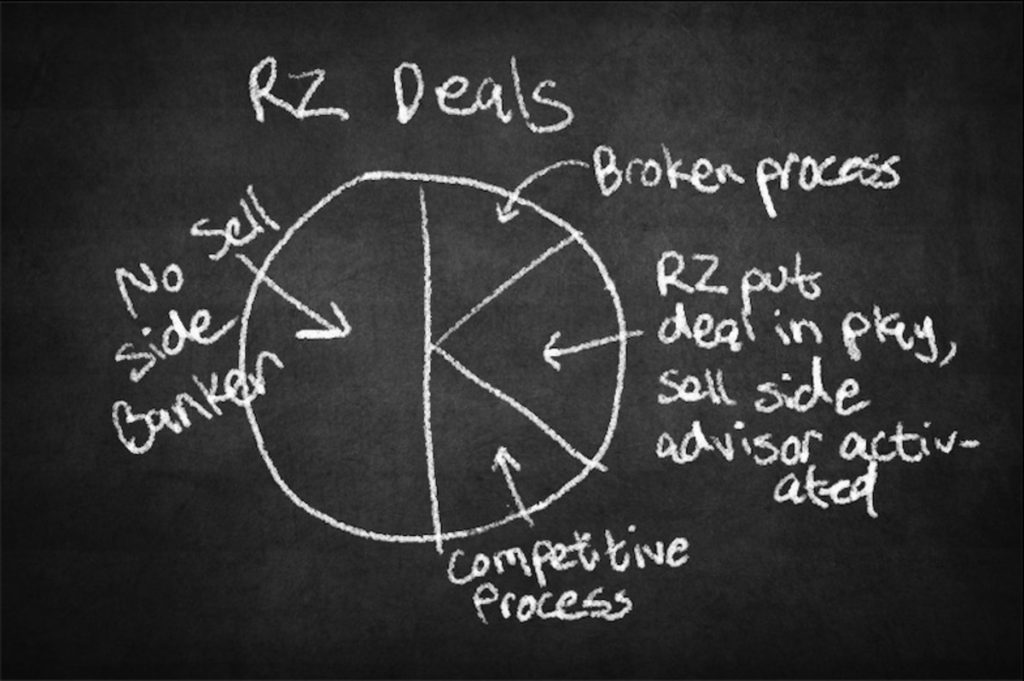

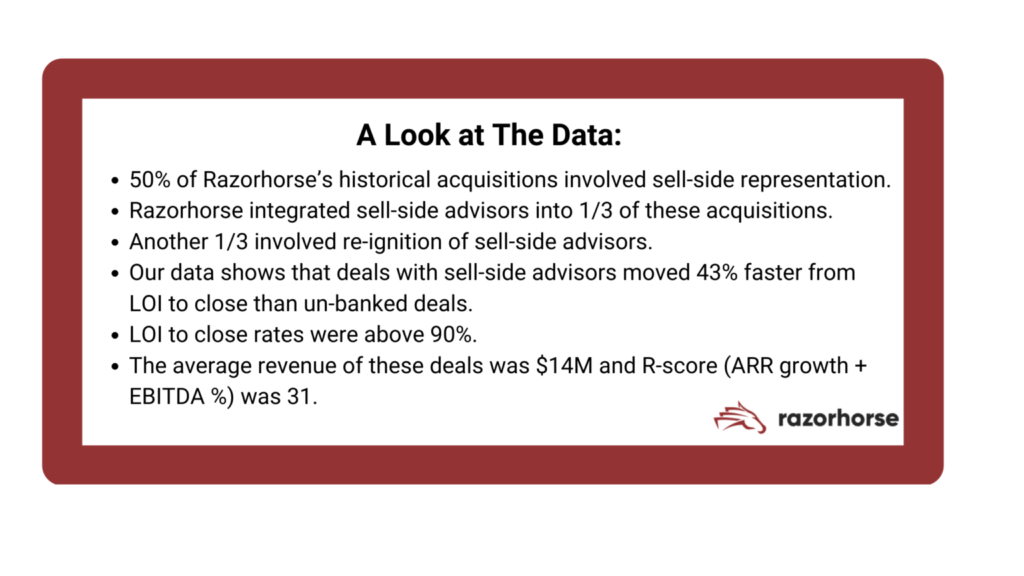

In fact, half of our 85+ acquisitions we’ve developed for our buyer network have involved a sell-side advisor. Roughly a third of those acquisitions didn’t have a sell-side banker involved when Razorhorse initially engaged, so we were able to help integrate sell-side representation into a process already underway. In addition, about another third of those transactions were sell-side processes which had stalled out and we were able to re-ignite with interest from one of our clients.

We love data at Razorhorse, and so dug into our own metrics to see what we could glean as we evaluated our success in working with sell-side advisors. In our most recent 24 months of transactions, our data shows that those involving a sell-side advisor moved from LOI to close 43% faster than our other transactions over the same period. Our LOI to close rate for these transactions was above 90%, the average revenue across these 11 businesses was $14M with an average R-score (growth + profit) of 31%. These are high quality businesses trading at strategic multiples, with an advisor on both sides of the table helping to streamline the process and optimize the outcome. M&A processes are time consuming and can become a major distraction to the selling party and their management teams. From our data we know that these processes are most efficient when a sell-side and buy-side advisor work together, which is why we’ve become a qualified source of vetted buyers for the advisors we work with. We urge all software and technology advisors to send us a message and get in touch; let’s meet, share notes and expand each other’s network.

Working Without Sell-Side Advisors

While we’re constantly thinking of ways to bring into the conversation our friends on the sell-side, we also sourced and worked on 14 transactions over the last 24 months without one. Across these 14 acquisitions, we saw an average R-score of 48%, average gross retention of 95% and average recurring revenue of $7.5M. These are also high-quality software businesses with talented management teams who are often open to a sell-side advisor introduction, but unaware of the scope of services provided. It’s clear to us there is ample opportunity for mid-market sell-side advisors to grow their practice and networks, even in markets as competitive as this one. As we strengthen our relationships with other specialized software and technology advisors, it becomes easier to make these referrals and introductions.

What’s Next

At Razorhorse, we’ve built proprietary systems to maximize the number of software CEOs and founders that we’re speaking with, learning about, and recommending for our buyer network. We leverage our database of nearly 250k software and technology services businesses to build these relationships, and often find incredible businesses with incredible founders who are looking for strategic capital partners.

If you’re working on the sell-side, send us a message and let’s explore how we can work together.