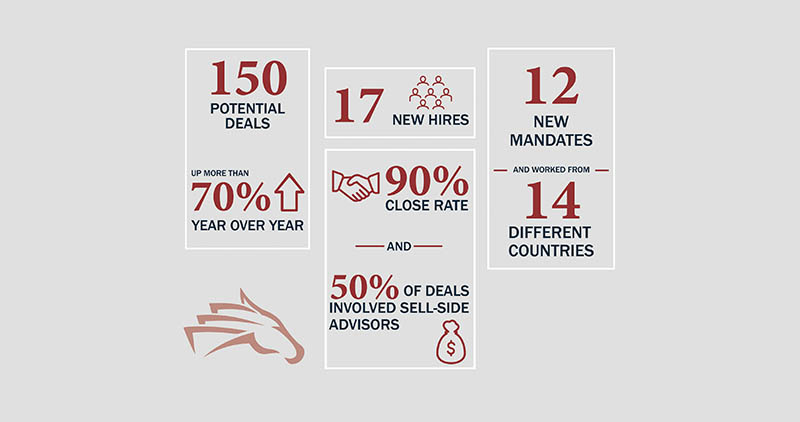

2021 was a year of tremendous growth at Razorhorse. We closed 15 transactions – nearly two times higher than in 2020 – brought on 12 new mandates

and worked from 14 different countries. Our team engaged and tracked over 6,000 companies.

New Mandates

To handle all this new demand, our team expanded with 17 new members.

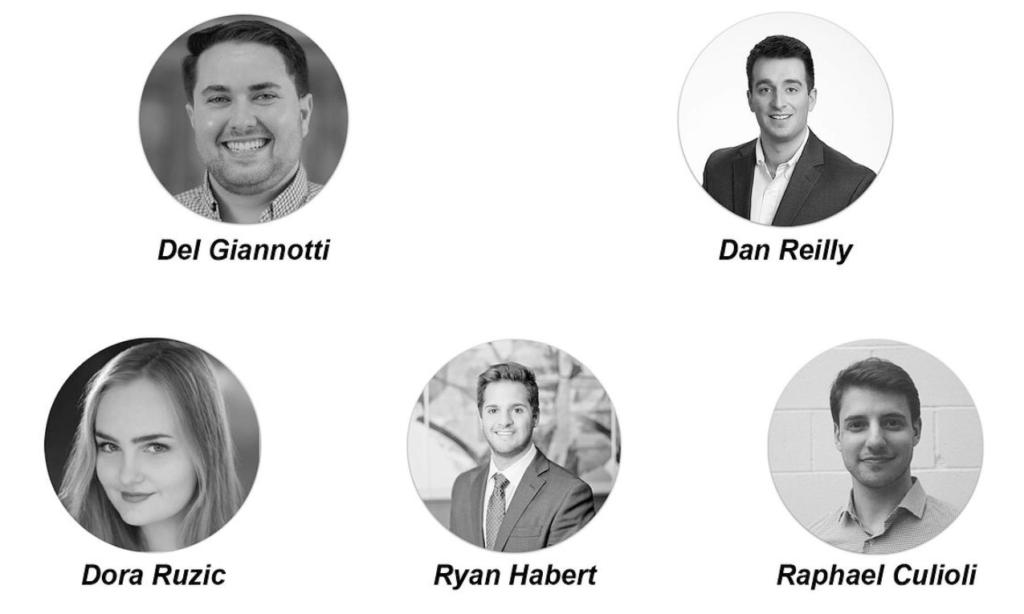

We expanded our deal team with the addition of Del Giannotti, Dan Reilly, Dora Ruzic, Ryan Habert, and Raphael Culioli, who all joined as deal professionals in 2021. They bring a wealth of experience in growth equity investing, software M&A, and financial analysis.

New Faces

Additionally, we released a new Market Mapping offering which experienced rapid uptake. We added eight new strategic market maps for our clients in spaces ranging from Marine Logistics to Employee Health and Digital Real Estate.

RazorU

At Razorhorse, we are transitioning from an apprentice model to a professional model. We have built a live and e-learning content library focused on the core competencies required in the private equity industry, combining all the relevant elements of enterprise sales. We cover topics our team and I have learned over the course of our careers, and we invite experts in from the outside to deliver content. Our goal is to create a world-class curriculum, platform, and credential for our team and potentially for clients and partners as well. More on this in the coming months.

What’s in Store for 2022

As our team scales and we further corner the software and tech-enabled B2B markets in North America, the UK, EU, and Australia, we are solidifying our unique market position as a complement to consultants and investment banks. The flywheel effect of the growing robustness of our data-set and market intelligence continues to strengthen our advisory services throughout our sophisticated network of institutional software investors.

From the Desk of Austin Scee, CEO

I love to learn, answer smart questions, solve difficult problems, and teach smart, genuine, hard-working people. Razorhorse allows me to do all those things. We’ve built a database of software companies that gives us an information asymmetry, and we are constantly improving our processes and methods in an increasingly spam-filled marketplace. Our team talks to thousands of CEOs, owners and bankers every year, and we’re constantly answering smart questions that our clients pose. Our database allows us to frame answers and take action. While Razorhorse doesn’t have a fund, we invest in our own deals and in the funds of our clients whenever we can, and more and more buy-side opportunities are emerging as we build.

More from Razorhorse

American vs. European Valuation

This is a question we get a lot when speaking to European founders and entrepreneurs. Given how much valuation…Read More

Three Trends in HCIT

Healthcare is a massive but slow-moving industry, which lags behind other industries approximately 10 years…Read More