Several years ago, we acquired a company for one of our clients. We had just finished a day of onsite due diligence to finalize our bid, and over dinner, one of the owners suggested the valuation in our IOI was light, because Salesforce was trading at 6x revenue.

At the time, Salesforce had about $4B in annual revenue, was growing 30% per year, and nearly all their revenue was high margin, annually recurring, multi-tenant SaaS revenue. The company we were evaluating was 1/100th the size ($40M in revenue), had several years of flat growth, and over ⅓ of their revenue was unprofitable professional services. Their product was delivered on-premise, and they sold perpetual licenses with maintenance to their customers. Only half their revenue was annually recurring, high margin maintenance.

In response, I quipped that I could throw a football further than Peyton Manning (who had just undergone neck surgery), but that didn’t mean I should make $20M a year playing football in the NFL. We ended up winning the deal, and acquired the company for a rational valuation given their KPIs and business model. I’m not sure my comment over dinner helped, but it’s one of my favorite deal stories.

That’s why we love the SaaS Capital valuation framework. They published a simple, common sense framework to help software owners understand the underlying dynamics of valuation.

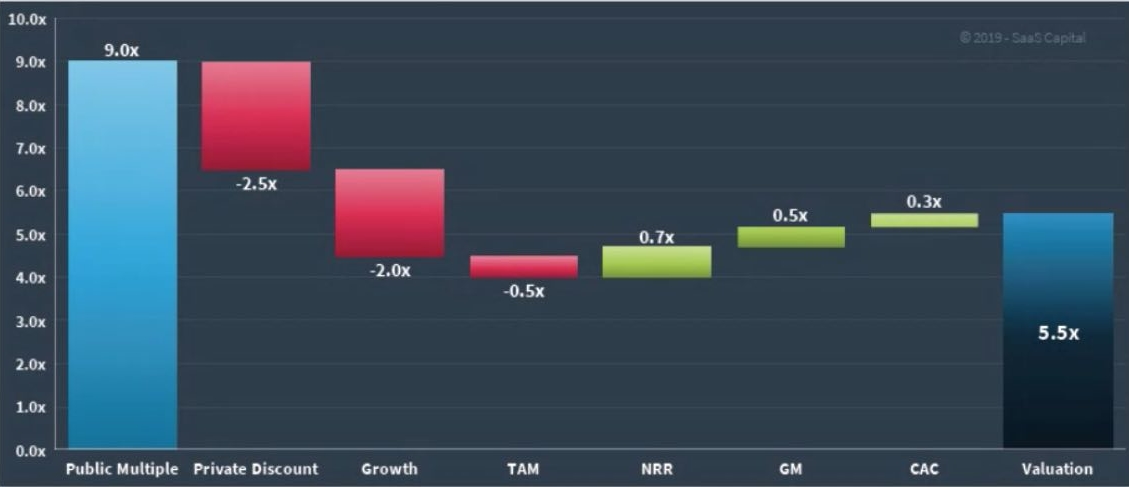

According to their framework, valuations need to be adjusted for liquidity (publicly traded), growth, market size (TAM), net revenue retention (NRR), gross margin (GM), and customer acquisition cost (CAC). We agree that all those factors are critical, and we see three additional factors that greatly impact valuation.

- Business Model (aka Revenue Quality)

- Revenue Size

- Marketing Timing

Business Model (aka Revenue Quality)

The SaaS Capital framework only focuses on SaaS business models. SaaS revenue to us means high gross margin (>80%), recurring, and sticky (gross retention >80%). SaaS businesses with gross margins <80% are either sub-scale, providing services for free and calling it support, or they’re paying significant royalties to other software companies as part of their cost of goods sold (COGS). The SaaS Capital framework accounts for this in their gross margin adjustment.

A simple gross margin adjustment doesn’t work for us, because we look at every business model on the software spectrum, from pure SaaS, to legacy on-premise software, to tech-enabled services. We value each revenue stream independently based on retention and margin profile using a discounted cash flow model. A comparables-based analysis is too blunt an instrument. We have seen companies calling themselves SaaS with gross margins as low as 20% (Adtech) to 50% (BPO). The SaaS Capital framework could work for these models, but it would not work for on-premise license/maintenance models.

On-premise software typically has even higher margins than SaaS revenue, because there is no hosting cost. SaaS companies have to keep the lights on. On-premise ISVs don’t. Still, SaaS revenue is generally considered more valuable than on-premise software for several reasons. SaaS models are more predictable, and allow for better investment and budgeting decisions. Pure SaaS solutions are also typically more modern, meaning less technical debt, less costly maintenance, and longer useful life. On the flip side, SaaS can be less sticky than embedded, legacy solutions.

Revenue Size

Size matters in software valuations. Holding all other factors constant, bigger software companies are worth more as a multiple of revenue or profit. There are several reasons for this.

First, the world financial markets dwarf the software market. Software is an attractive asset class, so the supply of investment dollars in good markets is massive relative to the number of large, liquid software companies. This supply / demand imbalance drives down return requirements, and increases valuation multiples. When this excess capital dries up, multiples plummet.

Second, regardless of the supply and demand issue, a typical PE firm models 30% IRR. An institutional investor buying $100M of Salesforce stock may only be looking for 15% returns. Plug 30% and 15% hurdle rates into a DCF model, and see how much it impacts valuation. The different hurdle rates make sense, because smaller companies are riskier investments than bigger companies, and investors in small companies tend to do a lot more work to improve the company than investors in big companies. Active investors need to be paid for the work they do, and most of that pay comes from the returns they help create.

Third, transaction costs (including integration) are a much bigger percentage of the transaction value for smaller companies.

Market Timing

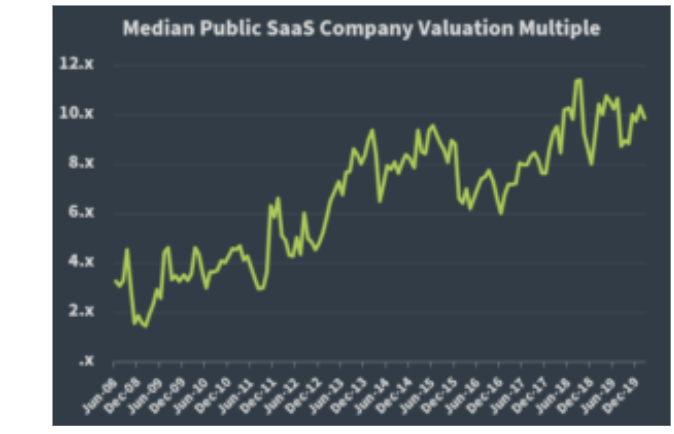

The past several years have been a historic sellers’ market in software. Looking at the SaaS Capital Index provided by SaaS Capital, multiples have more than doubled since the last market trough in 2009.

SaaS companies might be performing better today than they were in 2008 and 2009, but most of the multiple expansion is due to the market cycle we are in. Interest rates have been held low for a decade, lowering the market’s expectation of returns, and capital has piled into software as massive institutional investors look in the rearview mirror at returns.

The simple math on timing suggests that companies that don’t exit now may find that they improve all the elements of their business, and end up with a lower valuation in a year or three years than they would have if they’d sold into a sellers’ market.

Razorhorse Framework

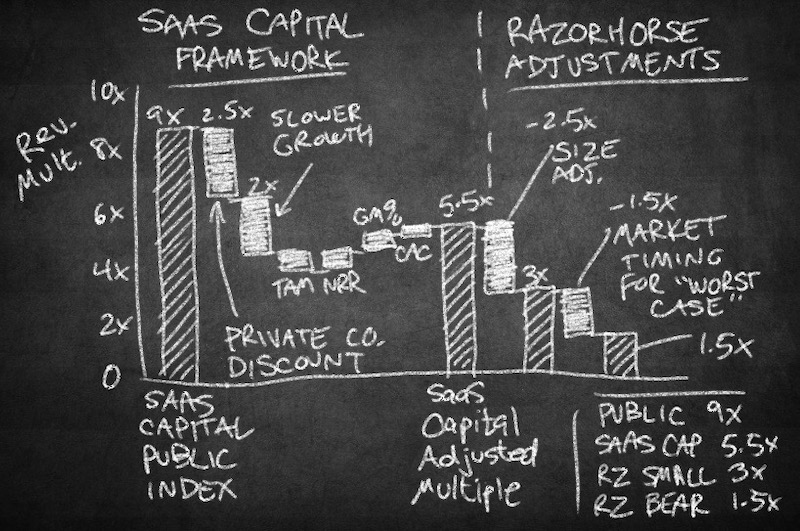

Tying this all together, the SaaS Capital framework suggests a private, slower growth SaaS company might expect a revenue multiple of 5.5x if the public index trades at 9x revenue, a 60% discount.

Building on the SaaS Capital framework, company size and market timing can greatly impact valuations. A $10M revenue company in a bad market may only fetch 1.5x revenue versus 3x in a hot market. A tech-enabled services model may only be worth half as much as a SaaS company with similar KPIs.

I’ll never throw a pass in the NFL, but flat, break-even, on-premise software companies can be transformed into growing, profitable, SaaS businesses. It takes talent, experience, discipline and patience. Software owners who can guide companies through that transition successfully are well paid, and that’s where some of the multiple goes.