Overview

The manufacturing software market is booming. The global market for manufacturing software is estimated to be $15 billion, growing at almost 13% and represents about 3% of the total software market. A multitude of macro trends are propelling this growth, indicating a promising outlook for the next 10 to 20 years.

Industry 4.0

Industry 4.0 is the fourth industrial revolution, which is characterized by the use of advanced technologies such as artificial intelligence, robotics, and the internet of things (IoT) to automate and digitize manufacturing processes. These technologies are driving the demand for manufacturing software that can help businesses to collect, analyze, and use data to improve their operations.

Reshoring

Over the next 10 to 20 years, the manufacturing market within the United States is poised for a significant transformation driven by the trend of reshoring – the process of bringing back offshore production and supply chain operations to domestic shores. This shift is set to become a pivotal driver of the manufacturing sector, spurred by a combination of factors including rising labor costs abroad, advances in automation and robotics, increased emphasis on supply chain resilience following global disruptions, and the imperative to reduce carbon emissions through shorter transportation distances. Reshoring promises to enhance the United States’ manufacturing competitiveness, create new job opportunities, foster innovation through closer collaboration between R&D and production teams, and contribute to a more sustainable and agile manufacturing ecosystem overall.

Growing Demand for Custom Products

Consumers are increasingly demanding customized products, which is putting pressure on manufacturers to be able to quickly and efficiently produce a variety of products. Manufacturing software can help businesses to design, engineer, and manufacture customized products more efficiently.

Regulatory Pressure

Manufacturers are subject to a variety of regulations, such as those related to product safety, environmental protection, and labor laws. Manufacturing software can help businesses to comply with these regulations by providing them with the tools they need to track and manage compliance requirements.

Ownership

A significant shift has occurred in the ownership landscape of manufacturing companies, leading to a departure from their original founders. These enterprises are undergoing transitions, either through acquisition by private equity firms or succession to younger family members. This transformation in ownership dynamics has consequently instilled an anticipation for these businesses to operate with a high level of sophistication, often leveraging advanced software solutions equipped with comprehensive features and functionalities. This reliance on advanced software is driven by the need to optimize operations, streamline processes, enhance decision-making, and ensure competitiveness in today’s rapidly evolving industrial landscape. As a result, manufacturing companies are increasingly embracing technological innovations to navigate complexities and achieve sustained growth.

Other Factors

As in all industries, manufacturers are under constant pressure to improve their efficiency and productivity in order to remain competitive. Manufacturing software can help businesses to optimize their operations, reduce waste, and improve throughput. Meanwhile, cloud computing is making it easier and more affordable for businesses to access and use manufacturing software. This is driving the adoption of manufacturing software by small and medium-sized businesses.

Razorhorse Market Map

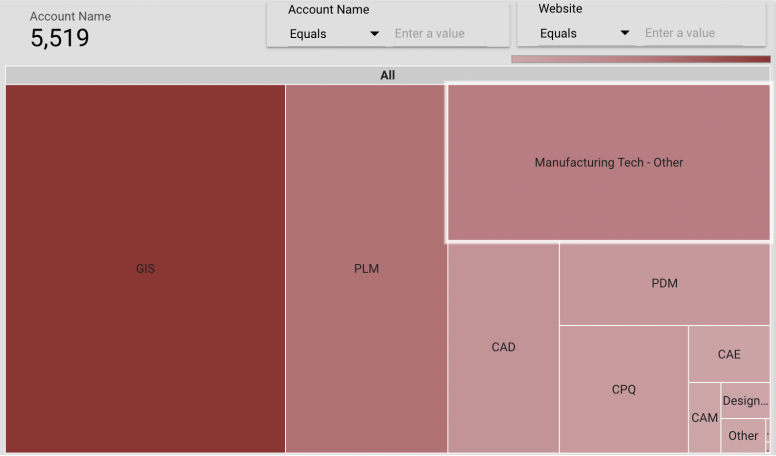

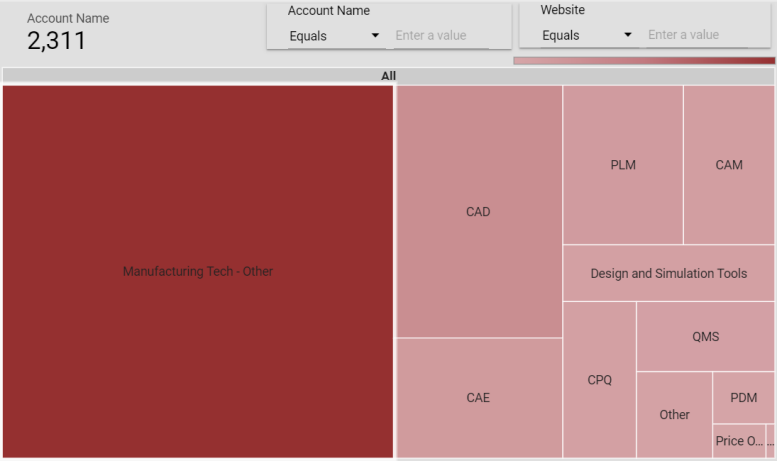

Razorhorse is at the forefront of this deal activity. We have a strong track record of deal origination in manufacturing technology, and we have a deep understanding of the market. We also have close relationships with key acquirers in the space, each interested in different parts of the manufacturing value chain, and each with their own criteria for size, growth, profit, and other key performance indicators (KPIs). Through our proprietary technology we are able to build market maps decomposing specific verticals by product and end customers.

In our efforts to explore manufacturing technology we have identified a total addressable market (TAM) of 5,519 companies.

Applying parameters that meet an agnostic view of our clients’ needs allows us to get a serviceable addressable market (SAM) of 2,311 companies in manufacturing technology. Those parameters are made up of filters on ownership, geography, funding, and company size.

Closing

In conclusion, the manufacturing software market is thriving, driven by a convergence of factors including Industry 4.0, reshoring initiatives, customization demands, regulatory pressures, changing ownership dynamics, and a relentless pursuit of operational efficiency. At Razorhorse, we are committed to staying at the forefront of this dynamic landscape. Our focus on identifying trends, market opportunities, and funding dynamics within manufacturing technology positions us to deliver valuable insights to our clients. We are eager to leverage our deep understanding of the industry, strong relationships with key acquirers, and proprietary technology to explore new funding trends and M&A opportunities, ensuring that our clients can navigate this evolving market successfully. With a TAM of 5,519 companies and a SAM of 2,311 companies, we are poised to uncover and capitalize on the promising prospects within the manufacturing technology sector, shaping the future of this dynamic industry.

Sources

1 Manufacturing Operations Management Software Market Report, 2030 by Grand View Research: This report estimates the global manufacturing operations management software market size to be USD 15.24 billion in 2022 and projects it to reach USD 37.94 billion in 2028. The report also projects the market to grow at a CAGR of 12.9% from 2023 to 2028.

2 Software Market Size, Share, Growth & Trends [2023 Report] by Grand View Research: This report estimates the global software market size to be USD 583.47 billion in 2022 and projects it to reach USD 652.61 billion in 2023. The report also projects the market to grow at a CAGR of 10.5% from 2023 to 2028.