In software and SaaS, it’s well understood that growth is rewarded with high valuations, and high profile exits. However, too often, this results in a “growth at any cost” mentality. For the best software businesses, growth is profitable, and private equity investors rightly invest heavily in growth. When the underlying cost model is profitable, and scaling well, the best companies can over-invest in growth and run at significant burn rates for extended periods. However, the growth imperative becomes a speculative strategy when a company’s underlying cost model is unprofitable. Some companies exit before the flaws in their business model are exposed, but most do not. When growth proves elusive, financing options become scarce, and company leaders can find themselves in a vicious cycle.

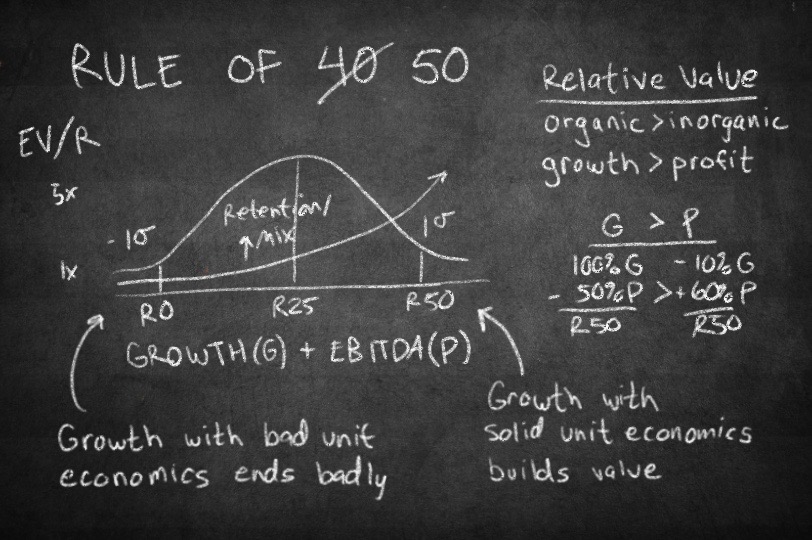

The “Rule of 40” has become a well known rule of thumb in the software world. Private equity investors target growth plus EBITDA to equal 40. The framework helps focus on the right balance between profit and growth.

Rule of 40: Revenue Growth + EBITDA margin should equal 40

To illustrate the point, consider ACME Co, a fictitious example of a story we see all too often. ACME was growing well until annual revenue reached $30 million. At that point, growth slowed due to price competition and challenges bringing in high quality functional leaders for the next stage of growth. Existing investors were tapped out, and with a challenging growth story, management wasn’t able to bring in new investors on terms acceptable to existing investors. They cut costs, but not deeply enough, putting them in a difficult position with customer negotiations. Needing cash flow to cover working capital, management felt the pressure to discount prices to win deals. And so the story goes.

ACME found itself at R8 on our Rule of 50 scale, an unenviable place to be. Fortunately, the story doesn’t need to end there. In our experience, valuation multiples for companies like ACME can be materially increased, usually in less than twelve (12) months, even with limited organic growth.

When we begin working with management teams, they usually ask how realistic it is to consistently operate at R50. Their underlying assumption is that a massive growth rate must be maintained, but that’s not necessarily the case. Even companies that are shrinking organically can operate at R50, although that’s rare.

Whether through growth, profit, or in combination, about 15% of software companies operate at or above R50. We know this, because in addition to our team’s combined experience acquiring and running companies, we maintain a proprietary database with operating metrics on thousands of software companies globally.

Growth + EBITDA > 50 is one sigma on the R-Score bell curve

Our analysis shows that the average software company operates at ~R25, and about one third (⅓) of companies operating at R50 are growing less than 30%. These companies have built sustainably profitable business models, and are disproportionately rewarded in terms of valuation.

Whether growth is organic or through acquisition, R50+ companies are rewarded by the public and M&A markets with substantially higher valuations. In fact, our data, and our experience indicate value creation accelerates as companies operate closer to R50. On the flip side, if ACME remains at R8, they will find their valuation suffers disproportionately.

As free cash flow increases, options to finance additional organic and inorganic growth increase. In software, size matters. Properly executed, an M&A strategy can dramatically improve exit multiples as well.

Understanding the Rule of 50, and the valuation impact, is an important first step. However, intentional and sustained discipline is required to operate at or above R50. It’s like training for a marathon. First, you need the right training plan. Over training will result in injury, and under training will leave you short of your goal. Even with the right plan, most runners perform better with a coach, and a support team.

In our experience, R50 companies work to remove speculation by building pro-forma P&Ls for the next 4-8 quarters that capture realistic quarter-over-quarter revenue growth by revenue type, and planned spend by % of revenue for every function. This discipline quickly highlights areas where difficult choices need to be made and provides a roadmap for every leader in the company, allowing everyone to align to drive shareholder value.